|

Paul Samuelson credits Alvin Hansen rather than Harrod for the inspiration behind his seminal 1939 contribution. The original Samuelson multiplier-accelerator model (or, as he belatedly baptised it, the "Hansen-Samuelson" model) relies on a multiplier mechanism which is based on a simple Keynesian consumption function with a Robertsonian lag:

so present consumption is a function of past income (with c as the marginal propensity to consume). Investment, in turn, is assumed to be composed of three parts:

The first part is autonomous investment, the second is investment induced by interest rates and the final part is investment induced by changes in consumption demand (the "acceleration" principle). It is assumed that 0 < b . As we are concentrating on the income-expenditure side, let us assume Ir = 0 (or alternatively, constant interest), so that:

Now, assuming away government and foreign sector, aggregate demand at time t is:

assuming goods market equilibrium (so Yt = Ytd), then in equilibrium:

But we know the values of Ct and Ct-1 are merely Ct = c0 + cYt-1 and Ct-1 = c0 + cYt-2 respectively, then substituting these in:

or, rearranging and rewriting as a second order linear difference equation:

The solution to this system then becomes elementary. The equilibrium level of Y (call it Yp, the particular solution) is easily solved by letting Yt = Yt-1 = Yt-2 = Yp, or:

so:

The complementary function, Yc is also easy to determine. Namely, we know that it will have the form Yc = A1r1t + A2r2t where A1 and A2 are arbitrary constants to be defined and where r1 and r2 are the two eigenvalues (characteristic roots) of the following characteristic equation:

Thus, the entire solution is written as Y = Yc + Yp is:

where the constants, A1 and A2 are solved by allowing for particular values of Y0 and Y1 (initial conditions). The roots determine the character of the dynamics of the system. The solution of the characteristic equation is easily determined by the elementary quadratic equation:

from where we can therefore derive the parameter regimes of b and c which yield the different dynamics. Firstly, we must establish the ranges of b and c which yield complex as opposed to asymptotic dynamics. This is observed in the discriminant D = ((1+b )c)2 - 4b c. Now, if D │ 0, then we have regular dynamics; if D < 0, we have complex dynamics. Thus, for regular dynamics, it must be that ((1+b )c)2 │ 4b c or simply:

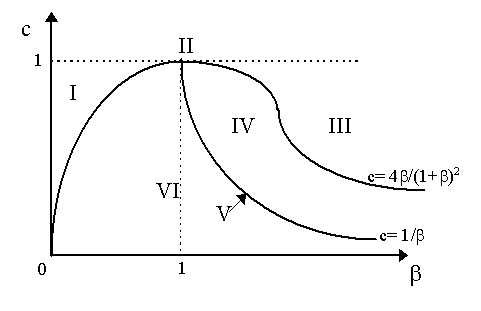

In Figure 1 below, we have drawn the function c = 4b /(1+b )2 in (c, b ) space. It is obviously a non-linear function bounded from above by c = 1 (note that when b = 1, then c = 4/22 = 1; any other value of b will give 0 < c < 1)). So, in the area below the curve c < 4b /(1+b )2 and we have complex dynamics (or oscillations), whereas above the curve, where c > 4b /(1+b )2 we have regular dynamics. Let us now assume that D > 0. Now, by the Schur Criterion, we know that sufficient conditions for damped monotonic behavior are:

Or, rewriting both as 1 - (1+b )c │ - b c and - b c > -1, and consequently combining them, 1 - (1+b )c > -1, the Schur conditions reduce to:

as a sufficient condition for damped, monotonic dynamics. Now, taking our discriminant, D = ((1+b )c)2 - 4b c, we know that for D > 0, it must be that:

thus a sufficient condition for damped, monotonic behavior is:

so it must be that 1 > 2b /(1+b ) or 1+b > 2b , or simply:

Thus, a sufficient condition for damped monotonic stability is that b < 1. Thus, in Figure 1, we can divide the area above the curve c = 4b /(1+b )2 into two parts. In that on the left (where b < 1 in area I), we have a stable, monotonic equilibrium. In that on the right (where b > 1 in area III), we have an unstable, monotonic equilibrium. At the point where c = 1 and b = 1 (implying repeated real roots, at point II) we have a constant stationary state out of equilibrium.

So far, so fine. What about the area with complex roots (i.e. below the curve c = 4b /(1+b )2)? Here, obviously, D < 0. However, using imaginary systems, we know that the "modulus" of the system is 1. If the real parts of the roots are greater than 1, then the system has explosive oscillations whereas if it is less than 1, then the system has damped oscillations. Now, the modulus is Í (a2 + b2) = 1 where a = (1+b )c/2 and b = Í (-D)/2. Now:

or simply:

Now, as the relevant modulus is 1 so that 1 = Í (a2 + b2) = a2 + b2, then for damped oscillations, it must be that:

and for explosive oscillations:

Obviously, we can draw the curve c = 1/b which forms the boundary between explosive and damped oscillations in the case of complex roots. This is done in Figure 1. Obviously, this is an asymptotic function which begins at c = 1 and b = 1. If c > 1/b (we are above the curve in area IV), then we have explosive oscillations. If c < 1/b , which is below the curve (in area VI), then we have damped oscillations. On the curve itself (area V), we have constant (harmonic) oscillations. All the parameter regimes are thus drawn in Figure 1. They are as follows:

How does this multiplier-accelerator reveal "cycles"? In fact, only parameter ranges (b , c) which are in situation E (constant oscillations) will yield constant cycles. All other parameter constellations will result in something else -- either complete stability or complete instability - (whether monotonic or oscillating). Thus, regular cycles are "structurally unstable" in the sense that they emerge only if there is a precise parameter constellation and any slight movement or displacement of the economy from these parameter values will end the regular cycle dynamics and enter into either explosive or damped oscillations. Thus, the Samuelson multiplier-accelerator model, as a model of the cycle, is incomplete as a theory of regular "cycles" as such, but a great advance in the theory of "macrodynamics" and fluctuations in general.

|

All rights reserved, Gonšalo L. Fonseca